Happy #FinancialFriday! This week we would like to highlight Individual Retirement Accounts and how they can be used as a tool to set you up for a secure financial future!

What is an IRA?

Individual Retirement Accounts, also known as IRAs, are accounts set up at a financial institution that allows individuals to save for retirement with either tax-free growth or on a tax deferred basis. Choosing between tax-deferred and tax-free is the difference between the two forms of IRAs: Traditional IRA and Roth IRA.

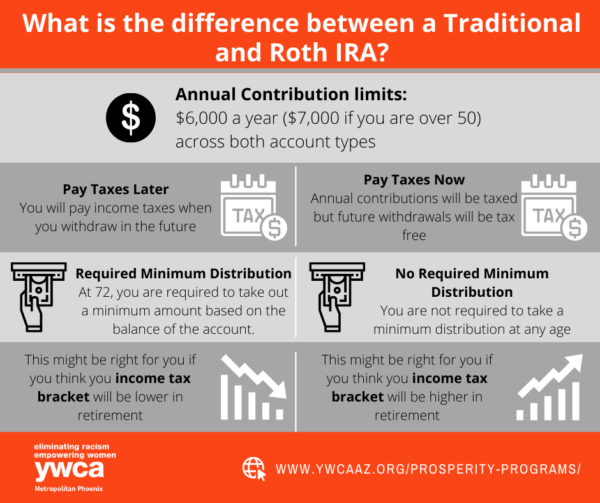

An IRA can be opened by any employed adult. You can contribute into the account on a regular basis, however you are limited to $6,000 annually or $7,000 if you are older than 50 years old. Depending on the type of IRA, investment growth within the account will grow free from tax until a withdrawal. An individual can begin withdrawing at the age of 59 ½ without penalty. Withdrawing funds prior to this age will result in a 10% tax penalty. There are some exceptions to early withdrawal recognized by the IRS that can help you to avoid the penalty. The information above is universal for both forms of IRAs. But what are some differences and benefits between a traditional IRA and Roth IRA?

Traditional IRA

A traditional IRA is available for employed adults from any income bracket. Contributions to a traditional IRA is tax-deferred. This means that all contributions and investment growth in the account will be not be taxed until it is withdrawn. Starting at age 59 ½, an individual can begin withdrawing from the account without penalty, however you will be taxed since it will be considered income. At age 72, traditional IRAs will have a required minimum distribution (RMD) that varies depending on the total amount within the account and your age. An individual failing to withdraw their RMD will face a 50% tax penalty.

All withdrawals from the account will be considered as income and therefore taxed as such. It is important to consider how much income you will need each month when you retire. If you are expecting to live off a higher income than you do now, be prepared for the possibility that you will be at a higher tax bracket. Also, consider that tax laws change, and you may not know what your tax obligation will be in the future. This is especially important for young adults deciding on which type of IRA to open.

Roth IRA

A Roth IRA is available for employed individuals that make under $139,000 or $206,000 a year for couples. Unlike the traditional IRA, contributions are taxed within the year they are made into the account. However, investment growth is not taxed! Therefore, if you contribute $20,000 into a Roth IRA and have growth of $5,000 for a total amount of $25,000, you will only be taxed for the $20,000 during the years you contributed to the account. In the same situation, a traditional IRA will be taxed on the total amount of $25,000 only when a withdrawal is made.

You can begin withdrawing from the account at age 59 ½. Since the tax was paid during the initial contribution, there will be no income tax to be paid during retirement. There is also no required minimum distribution to Roth IRAs, therefore you can withdraw as much and as little as you need. Always keep in mind that tax laws change, and rules relating to IRAs can change.

In conclusion, opening an IRA is a great step towards building your future. Most banks, credit unions, and financial institutions offer IRAs. Shop around and speak with as many as you can to make sure that you choose the best option for yourself. It is your money, and it is important that you trust the entity in charge of your IRA.

If you want to learn more about IRAs and other retirement options, please join us for one of our financial education classes! Our classes include information on IRAs and so much more! To view a current list of classes please see our calendar: www.ywcaaz.org/calendar/

If you have additional questions, please feel free to reach out to us at YWCA.ProsperityPrograms@ywcaaz.org